Reports say there’s been a big uptick in interest in leaving America with the overruling of Roe v. Wade, gun violence, political turmoil, and more. One popular post on Forbes advises how to move out of the US and the best places to escape. There are numerous choices, including moving to Canada.

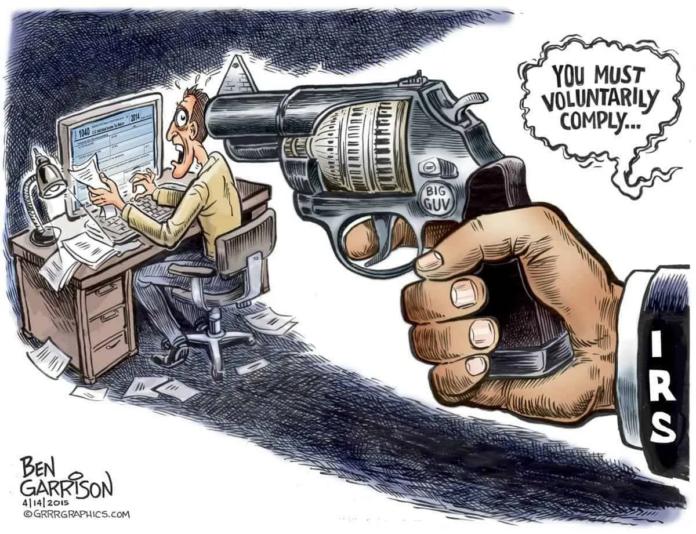

But if you go, is it temporary or permanent? Either way, most people probably assume that it won’t impact their citizenship. After all, there’s no reason that moving—moving anywhere—changes that. Yet it is surprising how many people get confused about U.S. taxes, and think that leaving the U.S. to live abroad means no longer paying taxes here—especially if you are paying taxes somewhere else. However, the mere fact that you live abroad—even forever—does not mean that you ever avoid U.S. taxes or the annual slog to file IRS returns. You might be paying tax in two places, to the IRS and to your new country of residence. In fact, if you want to stop paying U.S. tax, you have to go a step further. It’s a step that is not unheard of. Official U.S. Treasury Department records show that 2020 set a record for the number of Americans who renounced their U.S. citizenship or gave up their long-term green cards. Common reasons for renouncing can be family, tax and legal complications for people who generally live outside the United States.

There is an official list published quarterly, and the names for the fourth quarter 2020 made the annual total 6,707, a 237% increase from 2019. That may not sound like many, but the actual number of expatriates is often assumed to be higher, with many apparently not counted. Both the IRS and FBI track Americans who renounce. Some renouncers write why they gave up their U.S. citizenship, but tax considerations are often part of the equation. Expats have long clamored for tax relief. Adding fuel to the fire is FATCA, the Foreign Account Tax Compliance Act. This U.S. tax law was passed in 2010 and requires an annual Form 8938 filed with the IRS if your foreign assets meet a threshold.

FATCA spans the globe with an unparalleled network of reporting, requiring foreign banks and governments to hand over bank data about depositors. Non-U.S. banks and financial institutions around the world must reveal American account details or risk big penalties. Some renounce because of global tax reporting and FATCA. Dual citizenship is not always possible, as this infographic shows. America’s global income tax compliance and disclosure laws can be a burden, especially for U.S. persons living abroad. Americans living and working abroad must generally report and pay tax where they live. But they must also continue to file taxes in the U.S., where reporting is based on their worldwide income. A foreign tax credit often does not eliminate double taxes.

Then there are annual foreign bank account reports called FBARs. They carry big civil and even potential criminal penalties. The civil penalties can consume the entire balance of an account. Ironically, even leaving America can be costly. To exit, you must prove 5 years of IRS tax compliance, and getting into IRS compliance can be expensive and worrisome. If you have a net worth greater than $2 million or have average annual net income tax for the 5 previous years of $171,000 or more, you can pay an exit tax. It is a capital gain tax, calculated as if you sold your property when you left. A long-term resident giving up a Green Card can be required to pay the exit tax too. Sometimes, planning, gifts, separate tax returns for married persons, and valuations can reduce or eliminate the tax.

However, plan carefully, and run the numbers, as the tax worry can be real, even for those who can sidestep the tax. A more modest cost is administrative, as America charges $2,350 to hand in your passport, a fee more than twenty times the average of other high-income countries. The U.S. hiked the fee to renounce by 422%, as previously there was a $450 fee to renounce, and no fee to relinquish. Now, there is a $2,350 fee either way. The State Department said raising the fee was about demand and paperwork. As to the tax rules, if taxing most everything seem harsh, check out how the IRS taxes lawsuit settlements, sometimes taxing twice and even taxing wildfire settlements.

Check out my website.